Highlights for the Year:

- DehydraTECH Licensing Revenues Nearly Tripled vs. Year Ago (as Adjusted*) as New Licensees and New Product Launches Continue to Hit the Market

- FY 2023 Consolidated Gross Profit Showed Strong Growth at +20% vs. Year Ago, Building on the +37% Gross Profit Gain for Full-Year FY 2022

- We Continued to Execute the Transformed Vin(Zero) Business Model

- Cash Flows from Operations Improved Significantly With a 59% Improvement

- Completed Our Balance Sheet Transformation, Delivering More Streamlined Financials and Eliminating Items Not Relevant for Our Focused Growth Agenda

Toronto, ON. — Oct 24, 2023 — Hill Incorporated, formerly Hill Street Beverage Company Inc. (TSXV: HILL) (OTCQB: HSEEF) (“Hill” or the “Company”), is pleased to announce today that it has released its audited financial results for the three-month period and year ended June 30, 2023 (“FY 2023”), which can be found at www.sedarplus.com. The progressive bioscience implementation company is dedicated to building pathways to better and healthier living by leveraging deep CPG expertise to commercialize leading-edge technologies, crafting superior cannabis solutions and non-alcoholic beverage products globally. The financial information summarized in this press release is based on audited data for FY 2023.

DehydraTECH Licensing Revenues Nearly Tripled vs. Year Ago (as Adjusted∗ ) as New Licensees and New Product Launches Continue to Hit the Market

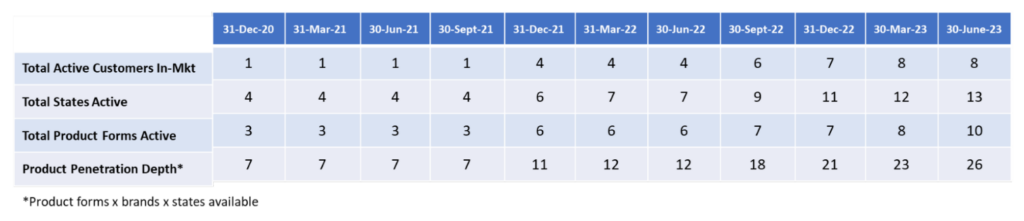

The continued growth of our DehydraTECH licensing business is a function of four key factors:

- new licensees – increasing our base of active licensees and brands;

- new states – new state launches expanding the geographic coverage for active licensees or brands;

- new product form factors – innovation to expand the number of DehydraTECH-powered consumer product forms and types in market to fill consumer needs and occasions; and

- deeper penetration of products across operations – driving deeper penetration of the breadth of product forms and brands across current and new states.

Following is a summary of the significant advances we have made against these key factors since we acquired the exclusive global rights to the DehydraTECH technology for use with THC products at the end of 2020 until the close of FY 2023.

The thirteen states where we currently have active operating partners represent a total population of 150MM1 and an addressable market of approximately $25.6B USD in estimated 2023 cannabis sales2 . That footprint covers states generating over two-thirds of the addressable market of $31.8B USD in projected total U.S. cannabis sales for 20233 .

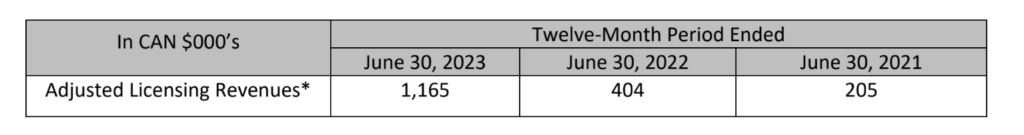

The following chart shows the growth in DehydraTECH licensing revenues over the last 3 fiscal years:

*Licensing revenues have been adjusted to reflect bad debts recognized in subsequent periods related to the previous year’s revenue.

Craig Binkley, CEO, comments: “We continue to have success working with our ecosystem of DehydraTECH licensees and commercialization partners. We have expanded each of the key operating factors that drive growth in our licensing revenues, as we expand the portfolio and presence of DehydraTECH-powered consumer products. Following on strong advances in FY 2023, we are looking forward to the completion of extensive ongoing R&D and product development projects with LPs and MSOs that we anticipate will result in important new DehydraTECH licensees and their product launches in the coming months.”

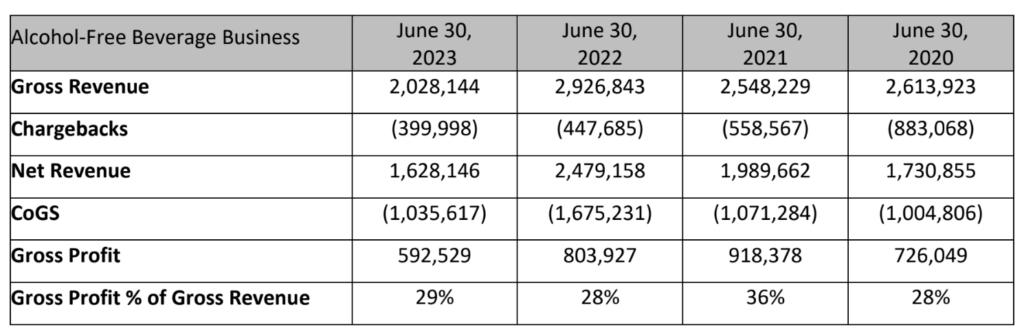

We Continued to Execute the Transformed Vin(Zero) Business Model

As outlined in previous communications, we transformed our Vin(Zero) business model at the end of FY 2022, with major adjustments across all the key areas of production planning, shipping and logistics, warehousing, sales and retail distribution. These changes have led to several key positive financial impacts:

- shortened our order-to-cash cycle;

- reduced the level of working capital that we hold in finished goods inventory;

- reduced warehousing and transportation costs with streamlined distribution;

- Reduced the need for more expensive temperature-controlled containers for our products as our forecasting, operations planning, and inventory logistics models create a more efficient shipping cycle.

As also previously communicated, this new streamlined commercial model creates a new and different cadence to the business, where more dramatic periodic swings on the recognized revenues are planned, and the business must be looked at across longer time frames. We now place procurement orders less frequently, but more rapidly convert those orders to revenues on the P&L and cash on the balance sheet.

See below for an annual breakdown of key financial results on the alcohol-free beverage business.

Consolidated Gross Profit Showed Strong Growth at +20%, Building on the 37% Gain a Year Ago

While the results of the individual business units should be considered separately on a quarterly basis and over time, consolidated gross profit increased +20% for FY 2023, building on the full year FY 2022 growth of +37%. The growth in gross profit for this year shows the dramatic financial impact of the DehydraTECH business on the consolidated financials and gross profit margins, despite a revenue decline on the alcohol- free beverage business driven primarily by the ordering cadence of the new business model.

Cash Flows from Operations Improved Significantly With a 59% Improvement

During the year ended June 30, 2023, Hill had a significant 59% improvement in cash flows from operations, with negative cash flow of $718,195 compared to negative cash flow of $1,748,980 during the year ended June 30, 2022. This significant improvement over the previous year demonstrates that we are able to grow our consolidated gross profit without requiring commensurate cost increases and highlights the Company’s increased focus on overall cost and cash management.

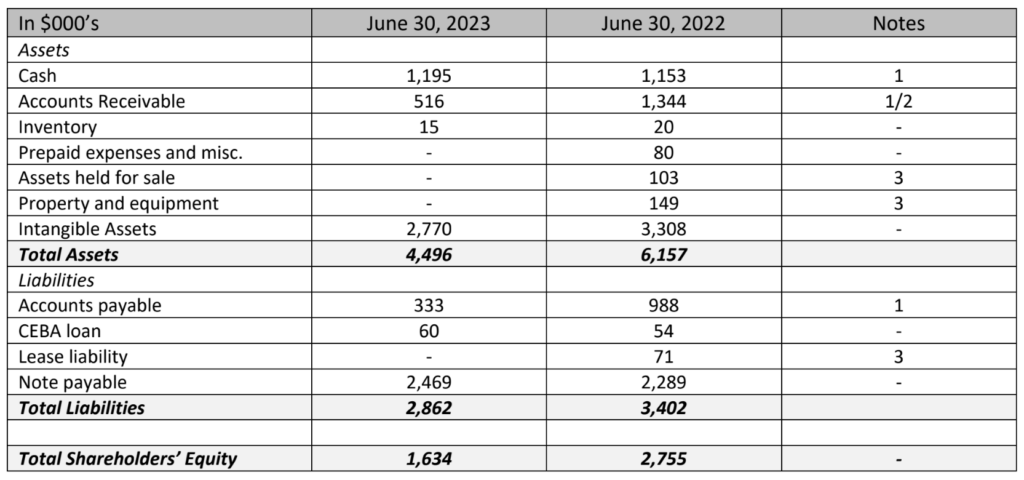

We Have Completed Our Balance Sheet Transformation, Delivering More Streamlined Financials and Eliminating Items Not Relevant for Our Focused Growth Agenda

Significant advances have been made to improve the overall financial operating health of the Company, reducing both receivables and payables and also eliminating items that are not relevant for our more focused growth agenda. Hill is pleased to provide a snapshot of its streamlined balance sheet below, with corresponding notes. For the Company’s audited financial statements and a comprehensive Company update by way of its Management Discussion and Analysis, please visit the Company’s profile at www.sedarplus.com.

Note 1: The Company has reduced its year-over-year trade payables by 66% while maintaining consistent cash reserves.

Note 2: As of Oct 23, 2023, the Company has collected over 80% of its receivables that were outstanding as at June 30, 2023. The remaining 20% is expected to be collected by Nov 30, 2023.

Note 3: As part of the Company’s focused efforts on DehydraTECH expansion in the United States, Hill exited its lease of the Canadian Lucknow cannabis R&D facility in February 2023. This allowed the Company to eliminate under-utilized assets while allocating additional resources to drive additional growth in the US.

Matthew Jewell, CFO, comments: “FY 2023 was a transformational year, both in terms of showing, by way of tremendous operating and financial growth, the potential of our DehydraTECH licensing business and moving on from legacy initiatives and unprofitable business units. The Company’s objectives are now clear, with an executive team that is laser-focused on the key actions to drive the Company towards long term success.”

Shareholder Approval of Hill’s Amended Rolling Stock Option Plan and Amendments to its Restricted Share Unit Plan

Further to the Company’s press release on May 4, 2023, the Company wishes to confirm that at its Annual General and Special Meeting of Shareholders held on May 2, 2023, shareholders of the Company approved (i) the Company’s amended rolling 10% stock option plan; and (ii) certain amendments to the restricted share unit (“RSU”) plan of the Company, which included an increase of the fixed maximum number of RSUs that may be issued by the Company from 175,616 to 323,520 common shares (on a post- share consolidation basis).

In accordance with the TSX’s new policy 4.4 governing security-based compensation plans, certain amendments were made to both the stock option plan and the RSU plan to ensure that the plans met all regulatory requirements. The full text of both plans can be found in the Company’s most recent management information circular, a copy of which can be found on the Corporation’s SEDAR profile at www.sedarplus.ca.

About Hill Incorporated (TSXV: HILL) / (OTCQB: HSEEF)

Hill Incorporated is a progressive bioscience implementation company that is dedicated to building pathways to better and healthier living by leveraging our deep CPG expertise to commercialize leading- edge technologies to craft superior cannabis solutions and non-alcoholic beverage products globally. Our Hill Avenue Cannabis business unit is pioneering the space where craft consumer products meet bioscience by combining our deep CPG commercialization expertise with our rights to use Lexaria Bioscience Corp’s ground-breaking DehydraTECH patent portfolio for product development, licensing and B2B and B2C sales of cannabis ingredients or products on a global scale. Our Hill Street Beverages business unit represents the Company’s legacy alcohol-free consumer beverage marketing and distribution business.

For more information on our business activities visit www.hillincorporated.com, to learn more about our DehydraTECH cannabis biodelivery technology, go to www.dehydratech-thc.com, or to check out Hill Street Beverage’s award-winning alcohol-free wine line-up and order product to be delivered straight to your home, go to www.hillstreetbeverages.com.

If you wish to sign up for the Hill Incorporated mailing list, click HERE.

For more information:

Matthew Jewell, Chief Financial Officer

matthew@hillincorporated.com

604-609-6154

FORWARD-LOOKING STATEMENTS

Statements in this press release may contain forward-looking information. Any statements in this press release that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements are often identified by terms such as “may”, “should”, “would”, “anticipate”, “expects”, and similar expressions. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances, such as future availability of capital on favourable terms, may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. The reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this press release are expressly qualified by this cautionary statement. The forward-looking statements contained in this press release are made as of the date of this press release. The Company does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as required by securities law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.