Hill Street Provides Selected Preliminary Unaudited FY2022 Financial Results Highlights and Operations Update to Shareholders

Toronto, Ontario–(Newsfile Corp. – October 6, 2022) – Hill Street Beverage Company Inc. (TSXV: HILL) (“Hill Street“, or the “Company“), is pleased to provide a letter to all shareholders from CEO Craig Binkley, with a preview of selected preliminary unaudited financial results highlights for the three-month and twelve-month periods ended June 30, 2022 and an update on operations.

Dear Hill Street Shareholders,

As I stated in my August 11, 2022 Update Letter, fiscal year 2022 was by far the most successful fiscal year in the history of Hill Street. That update included a significant review of the specific operational successes of the Company throughout the year that have helped to drive our financial results. While 2022 audited financials are due at the end of this month, I want to share a preliminary view of select unaudited results which show a strong continuation of the growth trend of the business. In addition, I want to share several operational updates on our business lines to provide context for these results and to preview our evolving business initiatives as we progress through FY23.

Stellar Q4 Performance Drove Significant Growth in Financial Metrics for Q4 and the Full Year

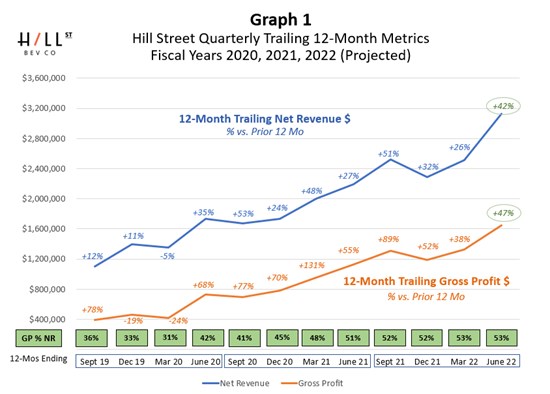

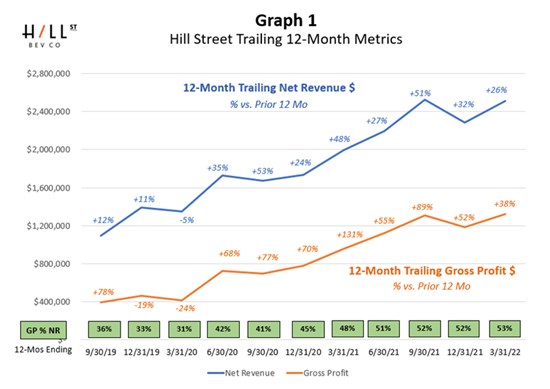

Anticipated consolidated net revenue more than doubled in Q4 of fiscal year 2022, growing a dramatic +118% vs. Q4 one year ago. Full fiscal year 2022 net revenue growth is expected to finish at a robust +42% vs. fiscal 2021, completing a very strong growth year.

Expected gross profit grew even faster than revenues. The quarter marks the first time that this key metric will have surpassed $500,000, with +127% growth vs. Q4 one year ago. Expected gross profit for the full fiscal year 2022 grew an impressive +47% vs. fiscal 2021.

These preliminary results evidence the Company’s sustained financial performance that we have previously highlighted. Graph 1 below, which was first introduced in my April 5, 2022 CEO Letter has been updated to include the quarterly trailing 12-month figures (TTM) for net revenue and gross profit from September 2019 to June 30, 2022, an analysis period that covers the past three full fiscal years. The figures above each line represent the change vs. prior year for that metric. Additionally, the figures in the green boxes represent the gross profit margin expressed as a % of net revenue.

As communicated previously, TTM net revenues have been increasing consistently between 24% and 53% since Q4 of fiscal 2020 – a period of nine quarters. TTM gross profits have been increasing even more rapidly, and the profit margin on the business has increased significantly from 31% in Q3 2020 to a sustained 52-53% for the last four quarters, including the anticipated Q4 2022 figure. Driving profitable growth is our mission and these key financial metrics indicate that we’ve been successful at that.

Graph 1

To view an enhanced version of Graph 1, please visit:

https://images.newsfilecorp.com/files/5205/139750_7033bedd242ec8a4_001full.jpg

Note: The preliminary fiscal year 2022 and Q4 financial results are unaudited, subject to revision, and anticipated to be finalized and released by late October 2022. The Company’s final audited financial results for the fiscal year 2022 and Q4 could differ materially from these selected preliminary results.

We Implemented a Significant Streamlining of the Vin(Zero) Alcohol-Free Wine Business in Q4

Early in the fiscal year, we began an evaluation of our commercial operating system for Vin(Zero), with many of the recommendations from that program being implemented in Q4. We made major adjustments across all the key areas of production planning, shipping and logistics, warehousing, sales and retail distribution. We expect to see several key positive financial impacts from these changes over time. Importantly, we have:

- shortened our order-to-cash cycle dramatically;

- reduced the level of working capital that we will be holding in finished goods inventory; and

- structured our forecasting, operations planning, and inventory logistics models to create a more efficient shipping cycle that will reduce the need for more expensive temperature-controlled containers for our products.

However, an important by-product of these changes is that we expect to see more dramatic quarter-to-quarter swings on the recognized revenues of this business. As we’ve previously explained, the alcohol-free wine business often had quarterly sales shifts resulting from depleted inventories from supply chain issues or COVID-related delays. These inventory problems often caused additional fees from retailers, multiplying the negative impact of the inefficiencies. It was therefore always our view that it was more accurate to look at the business over time to determine the true sales and financial trends.

In this new streamlined commercial model, we will be placing larger orders less frequently, but more rapidly converting those orders to revenues on the P&L and cash on the balance sheet. As a result, we will provide normalizations and longer-term trend analysis for our investors to better understand the true performance of the business.

Q4 of fiscal 2022 got a boost in estimated revenues because we shifted our model and converted warehoused finished goods inventory to revenue and importantly, into cash. We will provide more detail on those impacts when we release the audited results.

Importantly, while a lot of attention has been placed on the launches of our cannabis projects, the Vin(Zero) business has allowed us to generate cash for operations in a way that many other cannabis-related companies can’t. We continue to believe in the growth opportunity of this business as we continue to expand our view beyond Canada, and we believe that the new model will be a more efficient operational and financial approach to profitably capturing that growth.

DehydraTECHTM Technology Licensing Business Delivered a Strong Year of Expansion and Growth

As we’ve said before, integrating the DehydraTECH™ licensing business into the Company following our December 2020 acquisition from Lexaria Bioscience Corp. changed our business financially, operationally, and geographically. The DehydraTECH™ rights have allowed us to build plans to fundamentally grow our business beyond Canada into global markets, beyond beverages into cannabis technology, and beyond B2C into B2B scale opportunities as we work to build a global, multi-business company pioneering the space where premium crafted consumer products meet bioscience.

As noted previously, as of July 2021, the Company only had one DehydraTECH™ licensee operating live in-market with DehydraTECH™ THC-infused products – the owner of the “1906 Drops” line of products (“1906“), which were then available in four U.S. states, with 1906’s cannabis-infused chocolate products then also available primarily in Colorado.

By the end of fiscal 2022 our U.S. footprint was up to eight states, representing a population of over 90 million people[1] (+305% vs. the 29.5MM with which we started the fiscal year) and an addressable market of $19.2B USD[2] in estimated 2022 total cannabis sales.

With 1906’s expansion into Ohio and Pennsylvania in Q1 of fiscal 2023, we now have an operating footprint in the U.S. covering ten states with a total population of 115MM[3] and an addressable market of approximately $21.5B USD in estimated 2022 cannabis sales[4]. That footprint covers states generating almost two-thirds of the addressable market of $33B USD in projected total U.S. cannabis sales for 2022[5], up from our coverage of less than one-quarter of total U.S. cannabis sales at the beginning of FY 2022.

Expected revenues for fiscal year 2022 from DehydraTECH™ licensing are approximately $550,000 vs. just over $200,000 in fiscal year 2021. As we’ve previously highlighted, in fiscal year 2022, we have not yet realized the full impact of revenues expected from many of the DehydraTECH™ product launches and expansion plans of new and existing licensees that have been announced as they continue to roll out.

Recently Announced Expansions Are Now Hitting the Markets Live:

- 1906 Drops have expanded to Michigan, Pennsylvania, and Ohio in Q1 of fiscal year 2023.

- Lume launched their brand utilizing DehydraTECH™ in Michigan dispensaries in September.

- Neo Alternatives launched their Root 66 brand utilizing DehydraTECH™ in Massachusetts dispensaries in September.

- Folium Farms is expected to launch their Karma brand utilizing DehydraTECH™ in Oregon in early October.

Importantly, this licensing business unit has a very attractive financial structure. It is a low operating expense business, with even lower capital expense required of the Company. As the revenues continue to grow and make up a greater percentage of the total consolidated financials, we expect it to continue to improve the overall financial efficiency metrics of the company and further drive our cash efficiency.

We Are Re-evaluating Our Overall Cannabis Strategy for Canada and Withdrawing Our (V)ia Regal Cannabis Beverage Initiative from the Canadian market

Before discussing the important strategic rationale behind our decision to withdraw our (V)ia Regal cannabis beverage initiative from the Canadian market, it is important to note that the exceptional financial numbers that I have shared earlier in this update do not include any revenues from the sale of (V)ia Regal beverages in Canada. We will provide more details when we release our audited fiscal year 2022 results, but the revenues from our Canadian cannabis beverage business were very disappointing and overall, this has turned out to be an unprofitable initiative for Hill Street due to the complexities of the business system that was put in place.

Our rationale in coming to this decision was based on several factors:

- The cannabis beverage market is in very early-stage development but is already highly saturated.

Beverages hover around only 2% cannabis market share in Canada and around 1% in the US[6]. Yet there is an exploding number of distinct products fighting for that small and relatively stable share, increasing from around ten products in June of 2020 to over 100 by January 2022 in the Canadian provinces. That type of competitive intensity often drives price and margin compression as we’ve seen in other markets, as brands pay to secure scarce retail space and drop pricing to compete for consumer purchases.

Based on my almost forty years operating in alcoholic and non-alcoholic beverages across the globe with leading companies and brands, I personally believe that the ready-to-drink (RTD) cannabis beverage market is going to take a longer time and significant capital investment to develop. Large investments in capital equipment for manufacturing have been made by LPs in Canada and the US, but it will also take additional significant investment at retail for cold drink equipment – just as we’ve needed those major investments to drive presence, consumer purchase and growth in other beverage categories.

In addition, RTD beverages have higher costs to transport, warehouse, and stock at retail due to weight and bulk vs. other edible products, so the category will always be competing with more efficient cannabis alternatives for distribution and shelf space.

- There are significant regulatory challenges in the Canadian cannabis market.

The planning of our (V)ia Regal initiative, like many other cannabis initiatives in Canada, began before cannabis edibles were even legal, and before the final cannabis regulations were published by Health Canada. It is now well known that there are significant regulatory challenges in the Canadian cannabis market with very limited abilities to promote products.

Marketing and promotion in mainstream markets provide necessary navigation for consumers and drive differentiation for brands – it’s not just about delivering a product with a name and a logo. The regulatory limitations on cannabis promotion in Canada make it unfeasible for us to support a premium cost / premium priced product like (V)ia Regal. Because of Health Canada’s interpretation of Canadian cannabis promotion regulations, we have had to withdraw multiple elements of our marketing tools and basic messaging around the core product proposition and ingredients. Our inability to effectively promote the brand was further exacerbated by the complex chain of cannabis licenses needed in the route to market, as we could not operate directly without our own licenses.

- The (V)ia Regal business system is not financially efficient.

The supply chain and manufacturing model for (V)ia Regal was not financially efficient, unlike the key drivers of our success on our other two business lines. Hill Street took on significant amounts of inventory of alcohol-free wine – the base of the (V)ia Regal product, because of the long lead time order and production cycle for that base material. The alcohol-free wine imported as a bulk wine input into (V)ia Regal has a comparatively shorter shelf life than when imported as our Vin(Zero) finished goods. As we ordered bulk wine inventory based on early aggressive forecasts for the industry and, as early forecasts for the (V)ia Regal business did not materialize, we have had to write off significant amounts of that inventory due to code date expiration and spoilage.

- The cannabis market size in Canada is relatively small vs. our US DehydraTECH™ opportunity.

The (V)ia Regal business was our first cannabis initiative in Canada and was in development well before we acquired the rights to DehydraTECH™ technology. Canada has a total population of 38MM, with addressable cannabis market sales estimated to be just under CDN $4B2 in 2021. Contrast those figures with the US population of 115MM and approximately USD $21.5B market that we are currently operating with our DehydraTECH™ footprint in the US, and it’s clear that the larger opportunity for our resources is DehydraTECH™ in the US. The dramatic difference in the financial efficiency and profitability of the two cannabis businesses amplifies the rationale to prioritize the US DehydraTECH™ business.

While we remain committed to developing quality options for Canadian consumers to have great-tasting drinks with THC, the (V)ia Regal results to date and overall Canadian cannabis beverage market conditions have made it such that we believe it would be prudent for us to withdraw from this market at this time and to redirect our efforts to higher and more efficient returning initiatives in our portfolio.

Therefore, we are announcing today that we have made the decision with our Health Canada‐licensed manufacturing and sales partner Molecule Inc. to no longer produce any additional quantities of (V)ia Regal Pink Grape or White Grape sparklers, the two products that we launched together. Once existing inventories of (V)ia Regal products are sold through, they will no longer be available for sale in Canada.

Our Longer-Term View of Winning Consumer Occasions with Cannabis Beverages

While we are withdrawing from the RTD cannabis beverage business in Canada at this time, we do believe that there will be global opportunities for this business in the future, as the category and commercial systems more fully develop. At the appropriate time, we expect to return to product R&D and concept development on the cannabis infused RTD beverage category utilizing our patented DehydraTECH™ technology as the backbone vs. the other technologies and ingredient systems being used across the current RTD cannabis beverage market.

In the meantime, we also continue to work on securing a licensed partner in Canada that could support a DehydraTECH™ manufacturing operation, which would allow us to potentially launch a consumer form factor that could be mixed into a consumer’s favorite drink to win occasions. Interestingly, drops, mixes, elixirs and syrups are the largest segment of the cannabis beverage category in the US markets, and we are continually expanding our experience and knowledge base in those segments as we work with our US DehydraTECH™ licensees. These form factors leverage the infrastructure and presence of existing RTD beverages in the market – both at home and on premise – and allow for more individual customization of consumer beverages to their favorite types and flavors that they already buy and consume.

Lastly, we continue to evaluate options for our Mississauga, Ontario Lucknow facility but have paused any additional investments through the end of calendar 2022, as we utilize our cash on initiatives that have a higher and more immediate return.

We Continue to Make Progress on Building Our Corporate Reputation

As mentioned in the August update, we have now done significant work internally on the Hill Street corporate reputation strategies and plans for both B2B industry awareness and investor relations support. We are actively working with The Panther Group to help drive many of these reputation-building activities with us through their network and programs. We worked closely with them to make additional connections and introductions at two events in September 2022 – the Benzinga Capital Conference in Chicago and MJ Unpacked in Las Vegas. We will share additional programs and materials as they develop, but we believe that our exceptional business performance provides a strong foundation on which to expand and amplify our awareness and reputation.

Summary

In summary, we had a transformative fiscal year 2022 with major operational advances leading to the outstanding financial performance that we’ve previewed here. We enter fiscal year 2023 with the impact of many of those fiscal 2022 operating successes expected to hit our financial results in FY 2023, as well as several important new wins that have already kicked off this fiscal year.

We appreciate your support and hope you share our excitement about the FY22 financial results and the coming year.

Sincerely,

Craig Binkley, CEO

About Hill Street Beverage Company Inc. (TSXV: HILL)

Hill Street Beverage Company Inc. is a progressive non-alcoholic beverage and cannabis solutions company. We are pioneering the space where craft consumer products meet bioscience by combining our deep CPG expertise and our rights to use Lexaria Bioscience Corp.’s ground-breaking DehydraTECH™ patent portfolio for product development, licensing and B2B sales of cannabis ingredients.

For more information on our business activities or to check out Hill Street’s award-winning alcohol-free line-up and order product to be delivered straight to your home go to https://hillstreetbeverages.com/wines/.

For more information:

Craig Binkley, Chief Executive Officer

craig@hillstreetbevco.com.

FORWARD-LOOKING STATEMENTS

Statements in this press release may contain forward-looking information. Any statements in this press release that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements are often identified by terms such as “may”, “should”, “would”, “anticipate”, “expects”, and similar expressions. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances, such as future availability of capital on favourable terms, may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. The reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this press release are expressly qualified by this cautionary statement. The forward-looking statements contained in this press release are made as of the date of this press release. The Company does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as required by securities law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Not for dissemination in the United States.

[1] US Census Bureau, https://www.census.gov/quickfacts/fact/table/US/PST045221

[2] MJBiz Factbook 2022

[3] US Census Bureau, https://www.census.gov/quickfacts/fact/table/US/PST045221

[4] MJBiz Factbook 2022

[5] MJBiz Factbook 2022

[6] “Cannabis Beverages: A look at category trends & performance”, Headset 2022 Report, https://www.headset.io/industry-reports/cannabis-beverages-a-look-at-category-trends-performance#form

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/139750