Toronto, Ontario–(Newsfile Corp. – August 11, 2022) – Hill Street Beverage Company Inc. (TSXV: HILL) (“Hill Street“, or the “Company“), is pleased to provide a letter to all shareholders from CEO Craig Binkley, with a summary of the Company’s operational advances over the past fiscal year.

Dear Hill Street Shareholders,

June 30, 2022 closed the most successful fiscal year in the history of Hill Street Beverage Company Inc. (“Hill Street” or the “Company“) and as I write this, we are now deeply into the detailed year-end close and audit processes. While we won’t have those audited Q4 and full fiscal year 2022 financials ready for release until later in the fall, I wanted to take this opportunity to summarize the Company’s operational advances over this past fiscal year and to provide a brief recap of the financial strength that has been reported through Q3 of the fiscal year. Consistent with my April update, I want to ensure that we provide a broader perspective on the business over time versus relying on isolated quarterly results and news of the moment.

As we look forward to reviewing our Q4 FY22 and Full Year FY22 results, I want to take this opportunity to remind you of the underlying strength of the Company’s sustained financial performance over the past eight quarters, with this excerpt from the FY2022 Q3 Management’s Discussion and Analysis, a copy of which is available on the Company’s SEDAR profile:

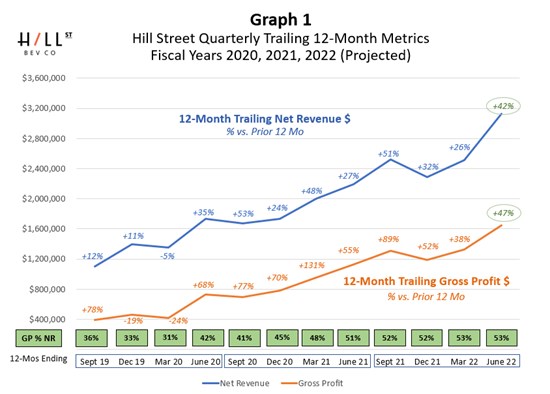

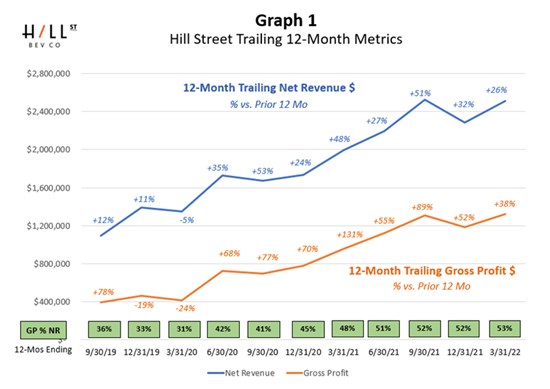

As the following graph shows, the financial results for Hill Street have been solid now for a full eight quarters. Trailing Twelve Month (TTM) net revenues have been continuously increasing between 24% – 53% vs. the prior year and gross profit has been even stronger at +38% to +131%. In fact, the key gross profit figures show that TTM gross profit dollars have more than tripled for the FY22 Q3 period vs. just two years ago for the FY20 Q3 period. As we’ve noted, the dramatic growth in gross profit dollars is accompanied by a significant improvement in our gross profit margins – which have increased as a percentage of net revenue from a low of 31% in fiscal year 2020 to over 50% in each of the past four quarters. As we’ve often mentioned, this significant improvement in gross profit dollars and gross profit margins does not yet show the impact of the DehydraTECHTM licensing deals announced with Lume in Michigan or the expansion of Dehydr8’s commercialization efforts into Illinois, Massachusetts, or Oregon.

Graph 1

To view an enhanced version of Graph 1, please visit:

https://images.newsfilecorp.com/files/5205/133529_8159f5d8248df8b7_001full.jpg

A Look Back at Fiscal Year 2022 – The Company Has Delivered Strong Profitable Growth While Driving a Transformation of the Business

Here is a snapshot of where the Company’s three revenue-generating business units stood as we began FY 2022 on July 1, 2022:

- Alcohol-Free Wine Business: Our VIN(ZERO) alcohol-free wine business operated almost exclusively within a Canadian footprint, with an emerging online direct-to-consumer channel that had seen a bit of a boost due to changes in consumer buying behaviour and newly available delivery choices resulting from the COVID pandemic.

- DehydraTECHTM Patent and Technology Licensing Business: We had just completed our first six months of integrating the transformative DehydraTECH™ licensing business into the Company following the December 2020 DehydraTECH™ rights acquisition from Lexaria Bioscience Corp. (“Lexaria“) The Company’s only licensee acquired in the rights acquisition that was operating live in-market with DehydraTECH™ THC-infused initiatives in July 2021 was the owner of the brand 1906 with their 1906 drops, then available in four U.S. states, and their cannabis-infused chocolate products, available primarily in Colorado. Those four operating states – Colorado, Illinois, Massachusetts, and Oklahoma – gave us access to a total addressable cannabis market population of 29.5MM1 and estimated 2022 cannabis sales of approximately $8B USD2.

- (V)ia Regal Cannabis Beverage Business: Our (V)ia Regal cannabis-infused beverage initiative in Canada was approximately six weeks into its initial launch through our Health Canada‐licensed manufacturing and sales partner Molecule Inc. (“Molecule“) and we had secured listing in the Ontario Cannabis Store (OCS). This (V)ia Regal business is our first cannabis initiative in Canada, which has a total addressable market population slightly larger than the four U.S. states mentioned above at 38MM, but with smaller addressable cannabis market sales, which were estimated to be just under $4B CAN3 in 2021.

- Financially, FY 2022 began by building on the base of FY 2021 that had delivered record net revenue, crossing $2MM for the first time with approximately $2,195K (+27% vs FY 2020) and record gross profit, crossing $1MM for the first time with approximately $1,124K (+55% vs. FY 2020).

Q1 of FY 2022 – Aggressive Starts for All Three Businesses

Q1 of FY 2022 delivered a fast start to the year, with key operating activities happening across all three business units.

- DehydraTECH™ Licensing Business

Most importantly, in July we launched the critical pilot program for DehydraTECH™ licensing in Michigan with our new licensee and commercialization partner Dehydr8, LLC (“Dehydr8“). Beyond opening a net-new state for DehydraTECH™ licensing revenues in Michigan with its population of ~10MM and its rapidly growing top-five U.S. estimated 2022 cannabis sales market of $2B USD4, this new relationship with Dehydr8 provided the foundation for the Company and its partners to begin developing a portfolio of DehydraTECH™-powered THC products and manufacturing and commercialization solutions for prospective new brands and licensees that could be used as we expand to new legal geographies. As we’ve mentioned before, this initiative was critical as we looked to fundamentally grow the business beyond Canada into global markets, beyond beverages into cannabis technology, and beyond B2C into B2B scale opportunities.

Until July 2021, the licensing relationships we acquired with the DehydraTECH™ rights were exclusively based on licensing the technology to B2C consumer product companies. The Michigan pilot is where we began developing the strategies, processes, and solutions to scale B2B DehydraTECH™ licensing business globally alongside a roadmap of continually increasing legal geographies.

By the end of August 2021, Dehydr8 had licensing agreements in place with LPs in Michigan and we began intense product development on a wide range of consumer product formats, from foods and beverages to topicals and other product forms that would benefit from the use of DehydraTECH™ technology in their manufacturing processes and would result in enhanced consumer experiences. Because of the different recipes, ingredients and manufacturing processes of these product concepts, our collective team implemented a broad range of product development initiatives to bring new products and form factors to life, which were now made possible because of DehydraTECH™ technology.

As we were developing and launching products in Michigan with Dehydry8, including the first ever DehydraTECH™ THC-infused multi-serve fast-acting dissolvable powder and DehydraTECH™ THC-infused gummies, we also focused on expansion opportunities with our pre-existing DehydraTECH™ licensees that we acquired with the December 2020 rights acquisition.

In August 2021, the Company’s licensee Boldt Runners Corporation (“Boldt Runners“), owner of Cannadips, the leading brand of smokeless nicotine and tobacco free dips in the US, announced that it would begin production of a new DehydraTECH™-powered THC-infused line of its top-selling CBD Cannadips products in California for launch in November 2021. This launch alone nearly doubled the total addressable population in the Company’s U.S. footprint to almost 79MM people and put operations into states with a combined $16B USD in estimated 2022 cannabis sales. For perspective, California alone has a greater population than all of Canada, with 90% higher equivalized estimated cannabis sales. Getting a foothold in California and intensifying our licensing relationship with the owner of the Cannadips brand were two major achievements that the Company has continued to build upon.

- (V)ia Regal Cannabis Beverage Business

In Canada, our (V)ia Regal initiative was fully into in-market launch activities as we entered FY 2022. Given the new nature of the business and systems, there was significant activity around integrating into the OCS vendor systems as they continued to evolve, as well as new sales and dispensary support activities developed with Molecule. Molecule also began to present the brand to additional provinces as they accelerated their roll-out initiatives beyond Ontario.

- VIN(ZERO) Alcohol Free Wine Business

One of the major opportunities in our VIN(ZERO) alcohol-free wine business as we entered FY 2022 was to look beyond Canada and take a more global view of its potential, as we have significant global beverage experience on our team, and we also work very closely with a globally-focused manufacturing partner. In August 2021, we launched a new distribution and promotional program in the U.S. with New York-based alcohol-free retailer Boisson, with their progressive retail concept that was created to serve the fast-growing movement toward a conscious approach of “better and better for you” consumption. We also expanded our sales much further geographically with new distribution in Australia, despite the intense pandemic situation in that country at the time. These expansions were early outcomes of the broader strategic re-engineering of our alcohol-free wine business to capture more profitable growth in the attractive global non-alcoholic beverage category.

Q2 of FY 2022 – Continued Expansion of DehydraTECH™ and (V)ia Regal, Normalized Sales and Inventories on the Alcohol-Free Wine Business

- DehydraTECH™ Licensing Business

As we transitioned into Q2 of FY 2022, we continued the intense DehydraTECH™-powered product development and testing initiatives in the Michigan pilot market and we also expanded the Dehydr8 licensing rights into Illinois to begin building relationships and R&D programs across the lake. As DehydraTECH™-powered 1906 Drops were then already available in Illinois, this license grant did not represent a net-new market for DehydraTECHTM licensing, but it did represent the opportunity for further B2B development in another top five U.S. state for cannabis sales.

Hill Street also continued to build upon the pre-existing DehydraTECH™ licensee relationships in Q2, as the Cannadips THC product launch went live in California in November 2021 and as we worked with the owners of the 1906 brand on additional state launches that were in their pipeline.

- (V)ia Regal Cannabis Beverage Business

In Canada, Molecule received its initial orders of (V)ia Regal cannabis beverages from new provinces British Columbia and Northwest Territories, as Molecule expanded their distribution beyond Ontario.

- VIN(ZERO) Alcohol Free Wine Business

The VIN(ZERO) alcohol-free business continued to operate on a strong track through the first half of FY 2022, although the Q2 FY 2022 financial results showed a normalization when compared to an extraordinary Q2 FY 2021. In Q2 FY 2021, sales were shifted and elevated dramatically beyond normal due to retailers and distributors restocking empty shelves and pipeline inventories that were emptied by global pandemic and supply chain issues in Q1 FY 2021. After this normalization and coupled with the Company’s discontinuation of its unprofitable alcohol-free beer business, we finished the first half of FY 2022 with 9% growth in net revenue and 12% growth in gross profit on a consolidated basis.

Q3 of FY 2022 – Full-Time CEO, Stock Ticker Change to HILL, and Significant DehydraTECHTM Expansion with Multiple Licensees

We turned the calendars to 2022 in January and Q3 began with some significant changes on the corporate side. I accepted the full-time CEO role in January 2022 after serving as interim co-CEO with fellow Board member Lori Senecal since February 2021. In addition to my belief in the future of Hill Street, its major shareholder HoldCo St. Catharines Ltd. also showed continued support of the strategic and operating direction of the Hill Street team by exercising warrants it held and making significant Hill Street stock purchases on the open market. Additionally, we made the important change of our ticker from BEER to HILL, reflecting the Company’s growth and evolution beyond the Canadian beverage business towards building a global, multi-business company pioneering the space where premium crafted consumer products meet bioscience.

- DehydraTECH™ Licensing Business

Q3 was also another quarter of significant advances in the Company’s DehydraTECH™ licensing business. 1906 Drops, the leading multi-state brand of fast-acting, low-dose, swallowable pills were launched into Arizona in March 2022, adding yet another top ten net-new state to our U.S. footprint with a total addressable population of 7.3MM people and estimated 2022 cannabis sales of $2B USD5. This marked an important first new state launch for 1906 Drops since becoming Hill Street’s licensee in December 2020, demonstrating an aggressive rollout plan that would see a steady stream of new state launches following closely thereafter.

Dehydr8, further amplifying its successes in the Michigan pilot, entered into a new DehydraTECHTM sublicensing deal in March 2022 with Lume Cannabis Co. (“Lume“), the top vertically integrated cannabis operator in Michigan and the largest single-state cannabis operator in the U.S.6 The launch of Lume DehydraTECHTM-powered THC products is expected later this month.

In Q3, we also expanded the DehydraTECHTM licensing rights for Dehydr8 beyond the Great Lakes to Massachusetts in March. Massachusetts is another strong top-five market where 1906 Drops was already operational, and we wanted to activate broader B2B commercialization in the state through Dehydr8. That expansion led to the July 2022 announcement of a licensing agreement with NEO Alternatives, LLC, owner of the “Root 66” brand of CBD extract products, who will launch a new line of fast-acting THC products that are expected to hit shelves this month.

- (V)ia Regal and VIN(ZERO) Businesses

In Canada, we continued to work closely with Molecule on sales and distribution efforts for (V)ia Regal. We also worked with our supply chain and go-to-market partners on our VIN(ZERO) alcohol-free wine business to continue re-engineering our approaches and business models to drive increased profitability and growth.

- Strong Financial Results Through Nine Months

In terms of the financial results through the first three quarters of FY 2022, net revenue for the 9-month period was already approaching the $2MM threshold that we had cracked for all of FY 2021, with approximately $1,994K in net revenue representing a 19% increase vs. prior year. We have also already surpassed the $1MM mark on gross profit year-to-date, with approximately $1,066K in gross profit representing a 23% increase vs. prior year. Gross margin as a percentage of net revenue increased from 51.7% to 53.4% as the Company’s DehydraTECH™ licensing revenues grew as a percentage of the consolidated revenues.

Q4 of FY 2022 Through Now – Continuing Aggressive DehydraTECH™ Licensing Growth, Adapting (V)ia Regal to Market Conditions and Re-Engineering the Alcohol-Free Business

- DehydraTECH™ Licensing Business

As we began the final quarter of FY 2022, we added yet another net-new U.S. state to our footprint in May as we expanded Dehydr8’s DehydraTECH™ rights into Oregon, and Dehydr8 immediately signed up Folium Farms as a sub-licensee LP. That brought our fiscal year-end DehydraTECH™ operating addressable U.S. footprint to eight states, doubling the number with which we started the fiscal year. The real impact, however, was even greater than double, as our ending eight states represent a population of over 90 million people (+305% vs. the 29.5MM with which we started the FY) with estimated 2022 cannabis sales of $19.2B USD (+240% above where we began the FY at $8B USD)7.

Importantly, many of the new state or licensing deals that have been announced in FY 2022 are only beginning to impact our financials in Q1 FY 2023. For example, while Lume was granted DehydraTECH™ rights in March, its product launch in Michigan is expected to occur later this month, as is the Massachusetts launch of Root 66 DehydraTECH™-powered THC-infused products, which rights were granted in July. Similarly, the Oregon product launch from Folium Farms is expected to hit retail shelves in September.

As we close our fiscal year, we must also note the significant progress that has been made to expand the DehydraTECH™ product portfolio and form factor concepts that are now available to licensees for multi-state launch. At the beginning of the year, 1906 Drops and 1906 chocolates were the only DehydraTECH™-powered THC consumer products being sold. By the end of the fiscal year, we had added DehydraTECH™-powered THC gummies, multi-serve dissolvable powder, dip pouches, and dissolvable tablets, with other form factors being developed for launch in FY 2023.

FY 2023 Is Already Off to a Good Start with 1906 Drops Expansions

In July 2022, 1906 launched their signature line of 1906 Drops into Michigan, further adding to the number of DehydraTECH™ form factors and products that are available to consumers in that key market. Continuing the aggressive footprint expansion, 1906 also just announced the 1906 Drops launch in Pennsylvania through a multi-state agreement with TILT Holdings Inc. Under that agreement, Ohio is expected to follow later in August.

Both Pennsylvania and Ohio will be net-new states for the DehydraTECHTM THC footprint, adding a total addressable market of almost 25MM population and $2.3B USD in estimated 2022 cannabis sales. So, we expect to end August with an operating footprint in the U.S. that covers ten states with a population of 115MM and approximately $21.5B USD in estimated 2022 cannabis sales. That footprint covers states generating almost two-thirds of the projected $33B USD in total U.S. cannabis sales for 2022, up from our coverage of less than one-quarter of total U.S. cannabis sales at the beginning of FY 2022.

Cannadips Sets the Stage for International Expansion of its CBD Dip Pouches

DehydraTECHTM licensee Boldt Runners, owner of Cannadips – the leading brand of dip pouches – also announced in July 2022 that it had expanded manufacturing agreements for its CBD products with Lexaria to include Europe, Japan, and South Africa. Boldt Runners licenses DehydraTECHTM technology from Hill Street for production of its THC line of products, and from Lexaria for production of its CBD line of products.

Like Hill Street, Lexaria and Cannadips are looking at global opportunities for DehydraTECHTM expansion as we build our roadmaps beyond FY 2023.

- (V)ia Regal Cannabis Beverage Business

During Q4, we also continued sales and distribution efforts on our (V)ia Regal business as Molecule engaged the sales agency Humble + Cannabis Solutions Inc. to drive retail support of its LP portfolio, including the (V)ia Regal products. In addition, the decision was made together with the Ontario Cannabis Store to lower the retail price of (V)ia Regal products in Q4 to encourage broader consumer trial. While the Company’s (V)ia Regal products are made with high‐quality premium ingredients producing a superior product, the Company felt that a price reduction was warranted given that consumers in the early‐stage, highly competitive and fragmented Canadian cannabis beverage market were still quite price sensitive in their trial choices, Additionally, the significant regulatory and legal challenges in Canada limited the Company’s ability to effectively market the brand’s premium ingredients in Canada to support higher pricing.

- VIN(ZERO) Alcohol-Free Wine Business

In Q4, we completed several significant changes in our business model for VIN(ZERO) as we looked to streamline the business, eliminate costs, and improve the overall financials on this important business. However, we will be in a better position to outline those specific changes and the resulting financial impacts once we have fully closed Q4 and announce the audited Q4 and final FY 2022 financial results.

Summary

In summary, we had a transformative fiscal year 2022 with major operational advances leading in front of strong financial performance that we’ve reported through the first three quarters and over the past two full years. We enter fiscal year 2023 with the impact of many of those fiscal 2022 operating successes expected to hit our financial results in Q1 FY 2023, as well as several important new wins that have kicked off this fiscal year.

While the business results have been strong, as shown in the April update, our share price performance and valuation have been depressed, with declines being similar to those across the entire sector over time. However, we are committed to building awareness of our positive profitable growth story, even as we manage our precious cash resources very conservatively.

We have now done significant work internally on the Hill Street corporate reputation strategies and plans for both B2B industry awareness and investor relations support. We have signed an agreement with The Panther Group to help drive many of these reputation-building activities with us through their network and programs. The Panther Group is an organization founded to solve business problems that impede growth for companies in the cannabis industry. They provide core solutions essential to growth marketing, business improvement, and capital raising, and we expect them to be an integral partner to our efforts throughout the rest of this year. We have engaged The Panther Group to amplify our efforts at major industry events including Benzinga Capital Conferences, MJ Unpacked and MJ Biz, as well as other key events and opportunities that they provide.

We are very pleased with the successes of FY 2022 and are extremely excited for FY 2023 and the positive momentum that we are confident that we can accelerate even further this year. We appreciate your support and hope you share our excitement about the coming year.

Sincerely,

Craig Binkley, CEO

About Hill Street Beverage Company Inc. (TSXV: HILL)

Hill Street Beverage Company Inc. is a progressive non-alcoholic beverage and cannabis solutions company. We are pioneering the space where craft consumer products meet bioscience by combining our deep CPG expertise and our rights to use Lexaria Bioscience Corp.’s ground-breaking DehydraTECH™ patent portfolio for product development, licensing and B2B sales of cannabis ingredients.

Hill Street’s beverage brands include award-winning VIN(ZERO) alcohol-free wines, and premium cannabis-infused (V)ia Regal Pink and White Grape Sparklers made from grapes imported from European vineyards.

For more information on our business activities or to check out Hill Street’s award-winning alcohol-free line-up and order product to be delivered straight to your home go to https://hillstreetbeverages.com/wines/.

For more information:

Craig Binkley, Chief Executive Officer

craig@hillstreetbevco.com.

FORWARD-LOOKING STATEMENTS

Statements in this press release may contain forward-looking information. Any statements in this press release that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements are often identified by terms such as “may”, “should”, “would”, “anticipate”, “expects”, and similar expressions. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances, such as future availability of capital on favourable terms, may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. The reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this press release are expressly qualified by this cautionary statement. The forward-looking statements contained in this press release are made as of the date of this press release. The Company does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as required by securities law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Not for dissemination in the United States.

_________________________________

1 US Census Bureau, https://www.census.gov/quickfacts/fact/table/US/PST045221

2 MJBiz Factbook 2022

3 https://www2.deloitte.com/content/dam/Deloitte/ca/Documents/consumer-business/ca-en-consumer-business-cannabis-annual-report-2021-AODA.pdf

4 MJBiz Factbook 2022

5 MJBiz Factbook 2022

6 https://www.wxyz.com/news/community-connection/an-inside-look-at-lume-cannabis-co-the-top-marijuana-producer-in-michigan-and-the-country

7 US Census Bureau, https://www.census.gov/quickfacts/fact/table/US/PST045221

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/133529